Let us help you make the move.

This is not an offer to lend. Program availability, terms, and conditions are subject to change at any time. Not all borrowers will qualify.

All home lending products are subject to credit and property approval.

The information contained herein is intended to be used as a reference for illustration purposes only, not a guarantee of what actual terms or conditions may be.

Loan Products & Programs

Conforming Fixed Rate Mortgages (FRM)

A fixed-rate mortgage has the same interest rate and principal/interest payment throughout the duration of the loan. The amount you pay per month may fluctuate due to changes in property tax and insurance rates, but for the most part fixed-rate mortgages offer you a very predictable monthly payment.

Conforming Adjustable Rate Mortgages (ARM)

The opposite of a fixed-rate mortgage is an adjustable-rate mortgage (ARM). ARMS are typically 30 year loans with interest rates that change depending on how market rates move. After your introductory period ends, your interest rate changes depending on market interest rates. The lender will look at a predetermined index to calculate how rates are changing. Your rate may go up if the index's market rate go up. If they go down, your rate may go down.

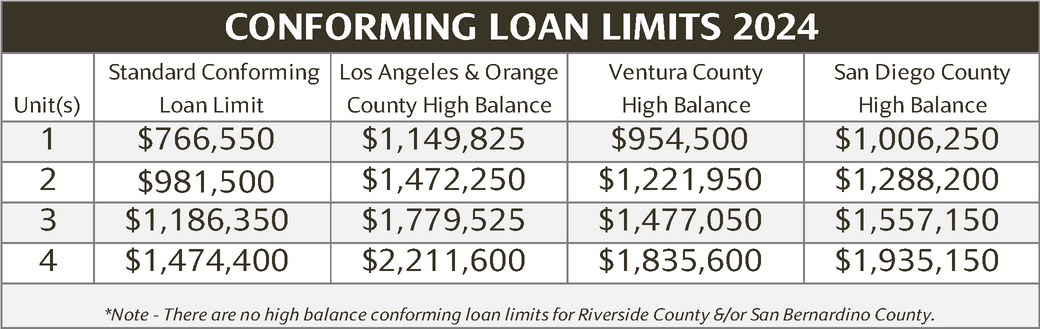

Jumbo Loans

A jumbo loan is a loan amount higher than the conforming loan standards in your area. Jumbo loan rates are usually similar to confirming interest rates, but they're more difficult to qualify for than other types of loans. Often times you'll need a higher credit score, higher down payment, and a lower DTI (debt to income ratio) to qualify for a jumbo loan.

FHA Loans

FHA Loans are insured by the Federal Housing Administration. An FHA loan typically has more flexible credit score requirements and generally requires a minimum down payment as low as 3.5%.

VA Loans

VA loans are insured by the Department of Veterans Affairs. A VA loan can allow you to buy a home with $0 down and lower interest rates than most other types of loans. You must meet service requirements in the Armed Forces or National Guard to qualify for a VA loan.

Bank Statement Loans

With bank statement loans, the lender uses bank statements to analyze a borrower's income instead of using standard documentation. These can be a great option for self-employed borrowers, however they often come with higher interest rates than conventional financing.

P&L Loans

These loans are similar to bank statement loans in that they can be a great option for self-employed borrowers. Profit and Loss (P&L) statements are used to establish income. As with bank statement loans, P&L loans also often come with higher interest rates than conventional financing.

Refinance Loans

When you refinance the mortgage on your house, you're essentially trading in your current mortgage for a newer one. Some refinance to make use out of their equity and take cash out of their home, while others refinance to get a better interest rate in order to lower their monthly mortgage payment.

Home Equity Loans

A home equity loan (HELOC) enables a homeowner to borrow money by leveraging the equity in the home. Typically during the "draw period" (usually the first 10 years), as you repay your outstanding principal balance your available credit is replenished - much like a credit card. At the end of the draw period, the repayment period begins (typically 20 years).

This is not an offer to lend. Program availability, terms, and conditions are subject to change at any time. Not all borrowers will qualify.

All home lending products are subject to credit and property approval.

The information contained herein is intended to be used as a reference for illustration purposes only, not a guarantee of what actual terms or conditions may be.

Resources, Tools, & Links!

Fannie Mae Home Buying Process (Website)

Mortgage Calculators (Website)

Current Freddie Mac Mortgage Rate Survey (Website)

All funds

exhausted

as of 4/7/23

This is not an offer to lend. Program availability, terms, and conditions are subject to change at any time. Not all borrowers will qualify.

All home lending products are subject to credit and property approval.

The information contained herein is intended to be used as a reference for illustration purposes only, not a guarantee of what actual terms or conditions may be.

Get Social

This is not an offer to lend. Program availability, terms, and conditions are subject to change at any time. Not all borrowers will qualify.

All home lending products are subject to credit and property approval.

The information contained herein is intended to be used as a reference for illustration purposes only, not a guarantee of what actual terms or conditions may be.

LA Mortgage, Inc.

NMLS 284169 CADRE 01211857

9171 Wilshire Blvd 3rd floor unit 321

beverly hills, ca 90210

Contact Us

kerry alan gelbard

mortgage loan originator

NMLS 240101 CADRE 00938573

This is not an offer to lend. Program availability, terms, and conditions are subject to change at any time.

Not all borrowers will qualify. All home lending products are subject to credit and property approval.

The information contained herein is intended to be used as a reference for illustration purposes only,

not a guarantee of what actual terms or conditions may be.